The Office 365 Licensing Gap – Part II

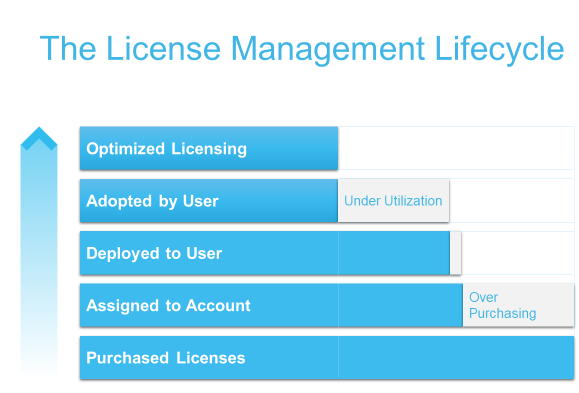

In Part I of this series, we discussed why each stage of the license lifecycle – the licenses purchased, assigned, deployed and adopted – are almost never the same and why over-licensing and under-utilization of licenses is so common.

In this post, we’ll discuss how over-purchasing can be remedied with a more effective license strategy underpinned by a data-driven approach.

Figure 1: The License lifecycle, showing the two key gaps – over purchasing and under-utilization.

Managing your Office 365 licenses

Reducing over-purchasing and thus closing the gap between licenses purchased and assigned requires closer co-operation between procurement, IT and the business. This enables those teams to work together more effectively, both to determine what licenses are needed and in what form to procure them from Microsoft sellers.

It also requires these teams to collectively embrace a different licensing strategy, one that rejects the up-front ‘license pool’ approach of the on-premise era, in favor of the much more responsive model that is enabled by the cloud, which largely eliminates the need to keep a surplus of licenses on hand.

What is fundamental to embracing a more modern strategy, and to enabling closer collaboration, is a data-driven approach to licensing.

This starts with an organizational license inventory and analysis to assess the current state of usage and to understand subscriptions better. The goal of this analysis is to identify over-licensing and license under-utilization – in particular, identifying unassigned licenses and users who under-utilize workloads in their base licenses, who could be downgraded.

In our analysis of 3.4m Office 365 users, we found 18% of licenses were unused. If we take the Office 365 E3 license as a good indicator of standard cost ($20 per user per month at list price) this presents a substantial opportunity.

Table 1: Workload utilization of Office Enterprise E3 and E5 licenses.

As the table above shows, there is an immediate opportunity with both E3 and E5 license users who use no workloads beyond Exchange.

Whilst the E5 sample is relatively small, the E3 sample size is large enough to be indicative of some substantial savings. Options such as Compliance, ATP, Office desktop apps and Cloud PBX definitely need to be taken into account, as well as the workload utilization.

Here are some examples of E3 and E5 users that illustrate this:

- E3 user that is only using Exchange who does not require the compliance option could now be downgraded to an Exchange Online plan

- E3 users using multiple workloads but have small mailboxes and use less than 1 TB of OneDrive storage could be downgraded to an E1

- An E5 user that uses multiple workloads but does not require Advanced Threat Protection can be downgraded to an E3

Identifying quick wins as described above is a great start, but to really develop an effective strategy, the organization needs to ensure that licenses purchased match the needs of the workforce. This can be accomplished by building out functional profiles for user roles based on a series of well thought out questions.

For example, determining how much authoring an Office 365 user does is key to understanding the right license. A user who reads documents but does not author them can access the applications through their browser, which permits a less costly license option than one that provides desktop versions of the applications.

Optimizing O365 license management

With the ability to report on and monitor license utilization and a process to capture user functional requirements in place, the last part to closing the over-licensing gap is to right-size purchasing based on that information and to transform the purchasing process from the on-premise ‘license pool’ approach to a more responsive model.

The detail of this is beyond the scope of this blog post, but in outline, it requires reviewing and streamlining all the steps in the process from purchasing to deployment. The industry has changed to allow more flexibility and accuracy with buying, and licenses can now be turned off and on much more quickly.

Having reviewed over-licensing we can turn our attention to the other major gap in the license lifecycle – the under-utilization of licenses caused by low levels of user adoption. This is the subject of the final post in this series, which you can find here.